E-invoicing in Saudi Arabia: Let’s start with Edisoft!

Prepare for the ZATCA mandate ahead of time. Start a pilot project with Edisoft. Let us take care of the technical work of adapting your documents to the ZATCA standard.

Edisoft APIs will act as middleware connecting the ERP and ZATCA system, ensuring 100% e-invoicing compliance. It automatically registers hundreds of ERP in a single click with ZATCA and receives a cryptographic stamp for each invoice.

Get benefits from digitalization

Efficiency boost: 5x faster document processing; save on printing, copying, sending and storage up to 70-80%; 20% less workload for employees due to automatic validation.

Control and transparency: electronically generated invoices help maintain better accuracy and effortless transactions with customers. No mistakes. No fraud. No data loss.

Improving ESG ratings: the generation of invoices electronically will reduce the usage of paper invoices and is environmentally friendly

Everything for your convenience in the new format

Onboarding for business partners: easy and automated connection of your buyers, contractors and suppliers to Edisoft e-invoicing solution

Cloud access: create, sign, reconcile, send, receive and store invoices in a simple, friendly and functional web application.

Integration and automation: seamless connection of your ERP, CMS and other systems with the Edisoft service for processing invoices, robotic execution of routine operations with documents without employees.

Why our solution?

Highly Scalable

One invoice or 100,000 invoices. The system can handle high load

B2B and B2C Ready

Create Standard Invoices (Notes) or Simplified Invoices (Notes)

Data Security

Edisoft ensures privacy, security and data integrity.

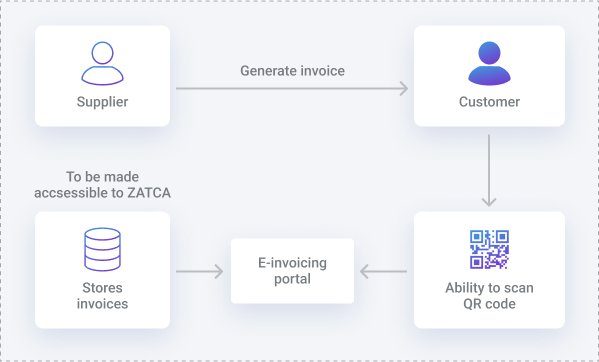

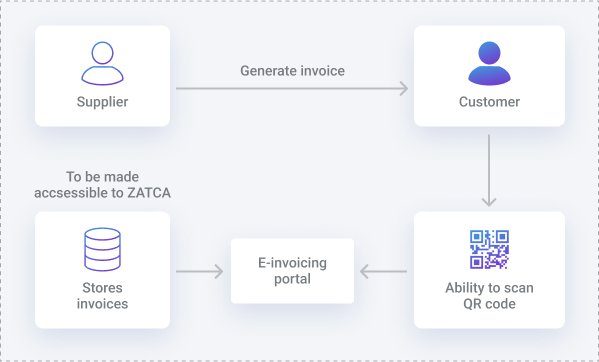

How E-invoicing is connected to the Edisoft ecosystem

What is important to know about e-invoicing?

As of 1 January 2023, Saudi Arabia's taxpayers must connect to the ZATCA platform and send e-invoices in the structured format. All e-invoices are to be reported and cleared in real-time with ZATCA. This phase is being implemented in waves. The criteria and timelines for the first seven waves, which were previously announced, are:

|

Wave

|

Criteria

|

Timeline

|

|

1

|

Turnover of more than SAR3b during calendar year 2021

|

1 January 2023 to 30 June 2023

|

|

2

|

Turnover of more than SAR500m up to SAR3b during calendar year 2021

|

1 July 2023 to 31 December 2023

|

|

3

|

Turnover of more than SAR250m during calendar year 2021 or 2022

|

1 October 2023 to 31 January 2024

|

|

4

|

Turnover of more than SAR150m during calendar year 2021 or 2022

|

1 November 2023 to 29 February 2024

|

|

5

|

Turnover of more than SAR100m during calendar year 2021 or 2022

|

1 December 2023 to 31 March 2024

|

|

6

|

Turnover of more than SAR70m during calendar year 2021 or 2022

|

1 January 2024 to 30 April 2024

|

|

7

|

Turnover of more than SAR50m during calendar year 2021 or 2022

|

1 February 2024 to 31 May 2024

|

Resident businesses should comply with the obligations of Phase 2 e-invoicing integration based on the ZATCA notification and undertake the relevant steps in making the required changes in their information technology systems. Taxpayers should comply with the Phase 2 requirements in line with the e-invoicing regulation to preclude possible penalties.

Simplified Tax Invoice

An invoice that is usually issued by a Business to consumer (B2C) containing all simplified tax invoice elements.

What is E-Invoicing (FATOORAH)?

Electronic invoicing is a procedure that aims to convert the issuing of paper invoices and notes into an electronic process that allows the exchange and processing of invoices, credit notes & debit notes in a structure electronic format between buyer and seller through an integrated electronic solution.

What is an electronic invoice?

A tax invoice that is generated in a structured electronic format through electronic means. A paper invoice that converted into an electronic format through coping, scanning, or any other method is not considered an electronic invoice.

Tax Invoice

An invoice that is usually issued by a Business to another Business (B2B), containing all tax invoice elements.