$ 10 billion

5,6 million

1500+

About Solution

Edisoft Factoring — cloud multibank factoring platform for debtors, factors and creditors. All transactions are run based on e‑docs and e‑invoices, certified by e‑signatures.

Edisoft Factoring gives easy and secure access to e‑factoring, allow to reduce costs, increase finance turnover, and boost business revenue. Edisoft Factoring using blockchain technologies to improve the security level of users and business processes.

Сhoose Your Role

Blockchain-based

How to Сonnect

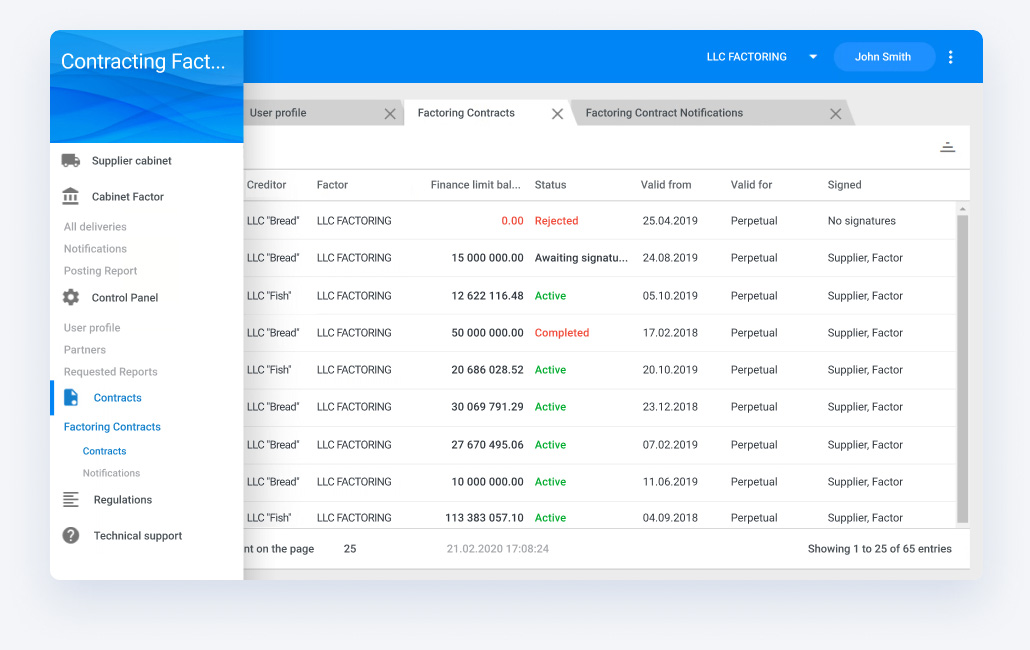

Web Cabinet

You will need an e‑signature and internet access

Integration wirh ERP

Connection via API. Ability to automate operations with documents and transactions.

Features & Benefits

Instant suppliers financing

Online interaction helps to quickly exchange electronic documents without couriers and mail. It is profitable and safe.

Auto verification

The platform helps to make a positive decision on financing with minimal costs. Edisoft Factoring processes a large amount of data in a few seconds.

Motivation to lower rates

Edisoft Factoring helps factors reduce commission and rates due to the low risk of electronic factoring transactions and savings on document flow.

Legally confirmed transactions

All transactions on FactorPat are legal. You can approve and sign an e-contract without using mail, phone calls, or personal meetings.

Process transparency

Edisoft Factoring helps track online documents, contracts, factoring requests and their status at any stage of the transaction.

Fraud protection

Edisoft Factoring protects users in contentious situations by validating electronic signatures. The platform reduces fraud risks.

Our Partners